Be an Investor, not a Landlord.™

Stop saving up and start BUILDING UP! Own hassle-free fractional shares of real estate in just a few clicks

Join a Deal Room and build your portfolio today

- $2,500

- *Minimum Investment

- MP

- *Price per BRX Token

- 10M

- *Tokens Available

- 24 Months

- *Hodl Period

Price, Farming & Rewards

Farming

TBA

*Coming soon!

Flash Sale

TBA

*Must buy 1st tranche to qualify

This offering is provided in reliance of Section 201(a) of the JOBS Act, Rule 506c of Regulation D. Accordingly, the sale of digital assets to US investors on this site is strictly limited to accredited investors only and reasonable steps shall be taken to verify the investors status as an Accredited investor. Learn more about accredited investor status on the click here.

Tokenized Real Estate Investments

Asset based Lending

Industry Marketplace for all your needs

Fractional ownership can diversify your portfolio

Fractional ownership offers the advantages of being able to deploy limited resources across a greater variety of real estate opportunities. Bricks allows investors to harness the power of blockchain technology and purchase tokenized shares of many different real estate development projects in the real world. Trading non-fungible tokens (NFTs) that are tied to real world assets (RWAs) is made as simple as possible when using the Bricks Exchange. Make deals and settle transactions instantly onto the Ethereum blockchain.

Control your investment horizon

With instant liquidity and 24/7 market access, you can sell whenever is right for you. Come and go as you wish but if you are planning on staying for a while, we invite you to yield farm staked tokenized assets with Bricks. When you lock up BRX non-fungible tokens (NFTs) on Bricks, you potentially could increase overall gains and get paid out via airdrop to an Ethereum address.

Choose from a variety of Tokenized RWAs

Invest in everything from core value-add strategies to high-yielding credit facilities that are backed by income producing properties. Portfolio diversification can help spread risk across different asset types while possibly blunting the effects of an under preformers within your portfolio. Conversely, Tokenized Real-World Assets (RWAs) can increase exposure to better performing assets as well. We are building unique investment tools for you that can put institutional grade asset management at your finger tips all without the institutional grade fee.

Deal Room Q/A Chat Board

Unparalleled transparency will be the hallmark of the Bricks Exchange and our Deal Rooms. Be informed before you buy. Get all of the answers to your property specific questions. Your journey with us can start today.

Instant Liquidity

Better Transparency

Fractional Ownership

Best-In-Class Support

Real Estate Agents:

Deal Room Offices are available.

Start Minting Deals.

Atlanta

Dallas

Las Vegas

Miami

New York City

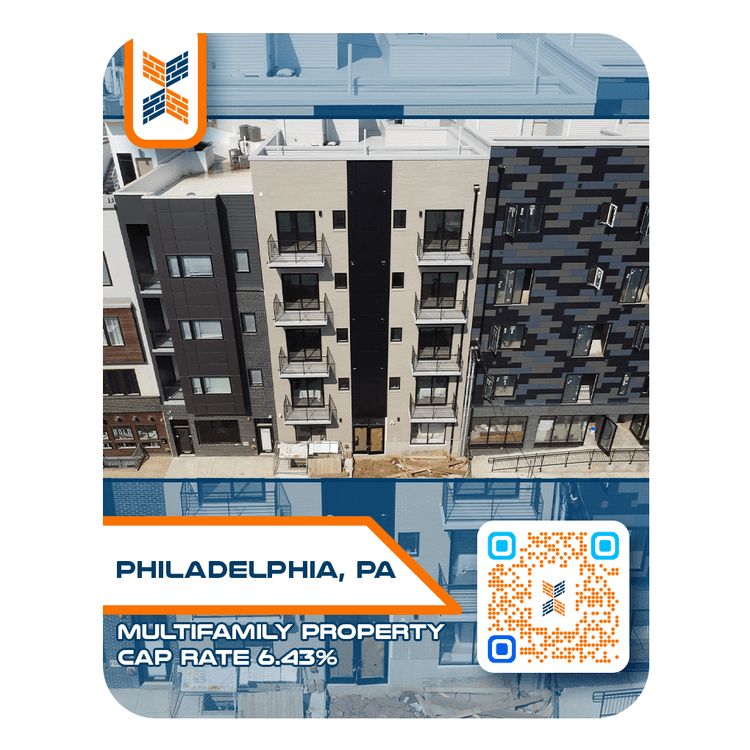

Philadelphia

Phoenix

Tampa

Partner With Us

Generate Revenue and Increase Brand Strength

Be Ahead of the Curve in Establishing Market Share

Be a Gateway to Web3 RWAs

Investors

There are three types of BRX tokens:

1.) Utility Asset Tokens (UAT) – _This is the base BRX token and is a utility on the Bricks platform. Ownership of this asset is for facilitating various activities within the portal and is not tied to anything of value except for providing discounts and VIP access to services and opportunities in the app. It is NOT intended as an investment vehicle.

2.) Hard Asset Tokens (HAT) – _This is the BRXe (Equity) and BRXd (debt). Tokenized ownership of the physical asset itself. This equates to things such as home-equity, mortgages, and securities. HAT tokens can be created as a means of refinance for mortgage purposes, joint venture partnerships, crowdfunding or the tokenization of the equity ownership of a given property.

3.) Synthetic Asset Tokens (SAT) – BRXo (Derivative Options) Tokenized derivatives that are valued based on their pairing to individual hard assets, futures contract or a group of the same. Though they are not representing ownership of the asset itself, their value may be analogized to a portfolio of real estate owned, controlled, or otherwise encumbered and pledged by entities partnering on the Bricks platform. Thus, these assets may be investable, insurable and tradable throughout the Bricks ecosystem.

Looking to invest in the big picture concept of Bricks Exchange and become a member of our team? We welcome you.

Contact us for Private Placement information.

Frequently Asked Questions

Deal room cards are potential future opportunities or current actual opportunities for which funds are being raised.

Until otherwise notified, all funds deposited in Bricks through the private sale will go toward the development of the company’s platform. A detailed “use of funds” can be found in our investors pitch deck, upon request. Following our launch and public sale of the BRX token, we will start funding real estate projects. Your initial investment will provide you with the BRX token, which may be traded for an asset-backed BRX token after the public sale has concluded.

Yes, but only after the 12 to 24-month hold period. During that time your tokens will be held in the vault. You may request a refund during that time with a penalty of 20%. After 12 months, the tokens will be released at a rate of 8.33% each month.

Not really, since all investor funds are pooled into one treasury account and deployed at our own discretion. That said, one day you will be able to customize your portfolio with a range of options. Stay tuned.

Currently, during our private sale phase, you can only swap USDC for BRX.

Simply connect your wallet to view your account details.

At the conclusion of the public sale you will notified that you’re able to swap your BRX tokens for BRX derivative property tokens. Features will be available at that time allowing you to set up your portfolio of real estate assets.

Yes. The process will be straight forward and easy to follow. But if you should get stuck, simply contact our help desk and someone will be eager to assist you through the process.

Yes. BRX is compliant with US federal law and therefore requires KYC/AML compliance to use the site. This process entails whitelisting. You must submit your identification documents in order to get whitelisted. Simply follow the instructions provided in the contact us form to submit your docs for whitelisting.

Your privacy is always protected. Information submitted is used only to verify your identity and investor accreditation status. We will never sell your personal info and will maintain procedures to keep it safe from misuse.

On this site, yes. US law requires that we limit the sale of our tokens to accredited investors only.

Answer: BRX is available for purchase inside and outside the US, but only to buyers who undergo the KYC/AML requirements. In the US, only accredited investors are legally able to purchase BRX. We advise you to consult with your legal and financial advisers before purchasing any BRX tokens. BRX tokens listed outside the US are not intended for the US audience or investors.